Introduction

Family wealth is often protected and passed down through special structures like Family Foundations and Trusts. These are tools used to hold assets such as real estate, investments, or businesses for the benefit of family members or charities.

With the introduction of UAE Corporate Tax (CT) in 2023, many families are asking:

Will our foundation or trust have to pay tax?

The good news is that the UAE’s Corporate Tax Law (Federal Decree-Law No. 47 of 2022), along with a May 2025 guidance, clarifies when these entities are taxed like companies and when they are considered “fiscally transparent” (i.e., not taxed at the entity level).

Understanding the tax treatment is crucial. It can mean the difference between a 0% tax outcome and a 9% corporate tax liability on your family’s investment income.

This publication explains, in plain language:

How UAE Corporate Tax applies to family foundations and trusts

What conditions must be met for transparency

What compliance steps are required

Key Definitions (Simplified)

- Family Foundation: In UAE tax terms, this means any foundation, trust, or similar entity used to hold and manage family wealth (for benefit of family members or a charity). It’s not a new legal form by itself, but a classification under the tax law for qualifying structures. Foreign foundations or trusts can also be treated as Family Foundations they don’t have to be formed in the UAE.

- Juridical Person: This means a separate legal entity for example, a corporation, an incorporated foundation, or an incorporated trust (like a trust registered as a legal entity). A juridical person can own assets, enter contracts, and sue or be sued in its own name (it has legal personality, independent from its owners). In the UAE Corporate Tax context, any juridical person is by default a Taxable Person (subject to corporate tax) unless an exemption or special treatment applies.

- Fiscally Transparent: A fancy way to say “look-through” for tax purposes. If an entity is fiscally transparent, it doesn’t pay corporate tax itself. Instead, its profits or income are treated as if earned by its owners or beneficiaries directly. For example, if a trust is transparent and earns rental income, that income is allocated to the beneficiaries and taxed (or not taxed) in their hands, not at the trust level. Many family structures aim for transparency so that the family’s passive income isn’t taxed at the entity level.

- Unincorporated Partnership (UP): Despite “partnership” in the name, this term covers any arrangement of two or more persons, set up by contract, that is not a separate legal entity*. In practice, many trusts or family arrangements without incorporation fall in this category. UAE law automatically treats Unincorporated Partnerships as fiscally transparent for tax. Think of a UP as an *entity without its own legal personality, so tax law ignores it and looks through to its members/beneficiaries. A Family Foundation that is transparent will be treated as an Unincorporated Partnership for tax purposes.

- Similar Entity: Besides formal foundations or trusts, the law also mentions any “similar entity” used for administering family wealth. This could include certain types of family holding companies or arrangements that aren’t ordinary commercial companies. The key is that it’s an entity intended for holding family assets and not running a business.

Two Categories of Family Structures: With or Without Legal Personality

- Those with separate legal personality (Incorporated): If your foundation or trust is established as its own legal entity for example, an ADGM or DIFC foundation, a UAE Waqf (endowment), or a trust incorporated under a specific law – then it is a juridical person. By default, it’s treated like any company and would be subject to 9% corporate tax on its profits. However, the UAE CT Law’s Article 17 creates a special option for these entities: if they qualify as a “Family Foundation” under certain conditions, they can apply to the FTA (Federal Tax Authority) to be treated as fiscally transparent. In other words, a qualifying family foundation with legal personality can elect to be taxed as an Unincorporated Partnership (no tax at entity level). We’ll explain those qualification conditions in the next section. Until an application is made and approved, an incorporated foundation/trust is taxable like any company.

- Those without separate legal personality (Unincorporated): This covers trusts or arrangements that are not incorporated – for example, many common law trusts or those formed by private arrangement in DIFC/ADGM that do not register as a legal entity. These are automatically considered Unincorporated Partnerships by the CT Law and thus are fiscally transparent by default. They do not need to file an application to be treated as transparent – the law already treats them as “flow-through” entities. Any income earned in such a trust is attributed directly to the beneficiaries for tax purposes. However, just because it’s transparent by default doesn’t automatically grant it the status of a “Family Foundation” for the special Article 17 treatment. If an unincorporated trust wants to be recognized as a Family Foundation (so that, for example, any companies it owns can also become transparent), it still needs to meet the same Article 17 conditions. The key point is: if your trust isn’t a separate legal entity, you already avoid entity-level tax, but you should ensure it meets the Family Foundation criteria if you want to leverage all the benefits (like extending transparency to its subsidiaries).

Why Does This Distinction Matter?

If you have a DIFC/ADGM trust or similar arrangement (no legal personality), you essentially start off tax-transparent – profits will skip the trust and be considered the beneficiaries’. If you have an ADGM foundation, a registered family foundation, or any incorporated entity, it would normally pay tax on its own profits unless you actively apply for the special transparent treatment. Understanding which category your structure falls into is the first step in determining its tax obligations.

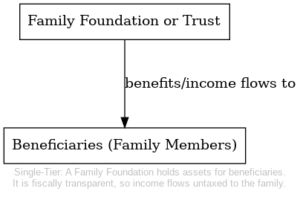

Single-Tier Family Structure: In a simple case, a Family Foundation or trust holds assets for the direct benefit of family members. As a fiscally transparent arrangement, the foundation itself is not taxed; instead, the income flows through to the individual beneficiaries.

When Can a Family Foundation Be Tax-Transparent? (Article 17 Conditions)

The UAE Corporate Tax Law sets out specific criteria under Article 17(1) that a foundation, trust, or similar vehicle must meet to be recognized as a “Family Foundation” eligible for transparent treatment [13]. In plain language, all the following five conditions must be satisfied:

- Beneficiary Condition: The foundation or trust must be for the benefit of individuals and/or public benefit entities only. This means all beneficiaries should be identifiable natural persons (people) or qualifying charities/public benefit organizations, or a mix of both. There’s no restriction that beneficiaries must all be from one family – any natural persons can be beneficiaries, and there’s no fixed limit on the number. If a charity or public benefit entity is among the beneficiaries, see the special distribution condition below. (Indirect beneficiaries count too – e.g. if the foundation owns a transparent holding entity which ultimately benefits a person, that person is considered a beneficiary[16].)

- Principal Activity Condition: The main activity of the entity must be the passive holding, investing, and managing of assets or funds for the family’s benefit. In other words, the foundation’s purpose should be wealth preservation/investment receiving income (like rent, dividends, interest), holding savings or investments, disbursing funds to beneficiaries, etc. It cannot be actively carrying on a commercial enterprise. Essentially, think of the foundation as a family vault or investment vehicle, not an operating business.

- No Business Activity Condition: The foundation or trust must not conduct any business or Business Activity that, if done by an individual, would require a commercial license[18]. This reinforces the above the entity itself should not be running a trade or providing services. For example, if Grandma Sara would need a trade license to do the activity personally (like selling products, providing consulting services, property development, etc.), then the foundation doing that activity would violate this condition. Purely holding assets, even if those assets are shares in a family company or rental real estate, is generally fine (that’s investment activity, not “business” in the licensing sense). But if the foundation itself starts operating a store or a factory, it fails this test. Bottom line: The foundation can own companies or assets, but it shouldn’t itself be operating a profit-making business.

- No Tax Avoidance Purpose: The main purpose of setting up and using the foundation must NOT be to avoid UAE Corporate Tax. This is a broad anti-abuse condition. In practice, if your foundation genuinely exists for family succession, asset protection, and wealth management, you’re fine – even if a benefit is that the structure ends up tax-efficient. But if the foundation is a sham or its only goal is to sidestep tax on operating income, the FTA could challenge this. For normal family wealth structures (which often were created before any UAE tax existed!), this condition is usually met. The guide essentially says the foundation’s primary purpose should be things like asset consolidation, inheritance planning, or charitable aims, and not solely a scheme to dodge tax.

- “Distribution” Condition (for charity beneficiaries): This condition only matters if any beneficiary is a public benefit entity (e.g. a charity). In that case, the law imposes certain distribution requirements to ensure the charity actually benefits. Essentially, the foundation must either timely distribute that charity’s share of income or meet other criteria so that the charity’s entitlement doesn’t just accumulate indefinitely[21]. The rules (set by Ministerial Decision No. 261 of 2024) include two alternative tests: one involves the charity not holding more than a certain portion (one-third) of the foundation’s assets/income, and the other requires distributing the charity’s portion within a specified timeframe. The details are technical, but the takeaway is: if you have a charity as a beneficiary, you need to actually pass funds to it (or keep its share below 33%) each year. Failing this condition will break the foundation’s tax-transparent status for that period.

All five conditions above must be met, continuously, for the structure to qualify and maintain Family Foundation status. If one condition is broken – for example, the foundation starts a side business or adds a corporate beneficiary – the entity can lose its transparent treatment (more on the consequences of losing status later). But as long as these criteria are satisfied, the foundation/trust is considered a Family Foundation under Article 17(1) and can enjoy pass-through tax treatment.

Multi-Tier Structures: Foundations Owning Companies

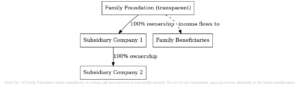

Family Foundations often hold assets indirectly for instance, the foundation might own a company (or a chain of companies) which in turn holds real estate or investments. The UAE guidance explicitly allows for such multi-tier structures to also be tax transparent, provided the structure is kept within the family wealth-holding purpose. Here’s how it works:

- If a Family Foundation (meeting the conditions above) wholly owns and controls one or more subsidiary entities, those subsidiaries can individually apply to be treated as Unincorporated Partnerships (transparent) as well. This can extend through multiple layers, as long as each link in the chain is 100% owned and each entity in the chain meets the conditions (no commercial business, etc.). The transparency can effectively “pass through” from the top foundation to the bottom of the chain.

- Wholly owned and controlled means the foundation (directly or indirectly) owns 100% of the shares or interests in the entity and calls the shots. Even an indirect chain is fine, but there can’t be any “outsiders” owning a piece at any level. If, say, the foundation owns 100% of Holding Company A, and A owns 100% of Subsidiary B, both A and B could qualify (each must separately apply for transparency) as part of the Family Foundation structure.

- No break in the chain: It’s crucial that every entity in the ownership chain either is the Family Foundation or has itself been approved as transparent under these rules. If one company in the middle doesn’t qualify or doesn’t elect to be transparent, that breaks the “transparent chain.” Any subsidiaries below that point cannot enjoy the tax pass-through. They’d be treated as normal taxable companies. In short, one opaque entity in the chain makes everything below it opaque.

- Passive, holding entities only: Subsidiaries that want to be transparent must meet the same conditions (via Article 17 and the ministerial decision) as the foundation. Typically, these subs are holding companies or special purpose vehicles (SPVs) that simply hold family assets (like real estate or investment portfolios) and do not engage in active business. For example, a limited liability company that only owns a piece of land or an investment portfolio could qualify. But if a subsidiary is actually running a business (e.g. a family-owned operating company with commercial revenue), it would not meet the “no business activity” condition and cannot be treated as transparent (it will be taxed as a normal company).

- Continuous compliance: The ownership and condition requirements have to be met throughout the relevant tax period for each entity. If in the middle of a year an entity in the chain ceases to be wholly owned by the foundation or starts a disqualifying activity, it will lose transparent status from the beginning of that tax year.

Multi-Tier Family Structure: An example where a Family Foundation owns 100% of a holding company (Subsidiary 1), which in turn owns another company (Subsidiary 2). All entities in the chain are passive investment holding vehicles and meet the Family Foundation conditions. In such a structure, each layer can apply to be fiscally transparent, so that ultimately the family beneficiaries are considered the direct earners of income. If any entity in the chain fails to qualify or drops out of the regime, the transparency is interrupted beyond that point.

What’s the benefit of multi-tier transparency?

Compliance Steps and Maintaining the Status

Qualifying as a Family Foundation is not automatic (except for unincorporated trusts as noted). Here’s what needs to be done to get and keep the fiscally transparent status:

- Application to the FTA: If your foundation or trust is a juridical person (has its own legal personality) and meets all the conditions, it must apply to the Federal Tax Authority for approval to be treated as an Unincorporated Partnership under Article 17[12]. There is a specific process for this (as per FTA Decision No. 5 of 2025). Only upon approval does the entity become tax-transparent. The timing of application is important too – it should be made so that it’s effective from the start of the relevant financial period if possible. (Unincorporated trusts don’t need to apply to be transparent – they already are by law but if they meet the criteria, they are deemed a Family Foundation automatically.)

- Tax Registration: Whether you are applying for Article 17 treatment or you are transparent by default, the entities still need to register with the FTA for corporate tax. Being transparent doesn’t mean you ignore the tax authorities altogether. In fact, the recent guidance says both entities that apply for UP treatment and those automatically treated as UP (e.g. unincorporated trusts) must register as Taxable Persons[36]. During registration, they would indicate their status (there may be special fields for an Unincorporated Partnership/Family Foundation). This ensures the FTA knows about the structure even if the entity itself won’t pay tax.

- What if something changes? If at any point an entity no longer meets the conditions, its transparent treatment ceases from the start of that tax period. In practice, that means the entity would become subject to tax as a normal company for the entire year in which the failure occurred. Example: A Family Foundation starts a new active business in March 2026 – it would be considered non-transparent for all of 2026, and it would need to pay corporate tax on its 2026 profits. (It could potentially reapply for 2027 if it discontinues the disqualifying activity.) Similarly, if a subsidiary in a chain breaks the chain, that subsidiary and any below it are out of the regime from that year forward. It’s crucial to notify the FTA if you no longer meet the conditions failing to do so could lead to penalties. Conversely, if a previously disqualified entity later comes back into compliance (e.g., sells off a business line), it might be able to reapply for transparent status in the future.

- Tax Returns: A Family Foundation that is treated as transparent will generally not file a normal corporate tax return (since it doesn’t pay tax itself). Instead, its beneficiaries might need to report the income. However, under current UAE rules, individual beneficiaries aren’t taxed on investment income or personal real estate income, and if beneficiaries are foreign or exempt entities, they likewise might not owe UAE tax. The FTA may still require the Family Foundation to file an information return or report distributions, etc., as part of transparency. Additionally, if the foundation had any non-UAE source income that was taxed abroad, beneficiaries might claim foreign tax credits in their own filings the guide covers this scenario, implying some reporting will occur to allocate such credits. Always check the latest FTA guidance on filing obligations for transparent entities.

- Ongoing Governance: The tax regime incentivizes maintaining a proper governance and record-keeping. Ensure the foundation or trust’s activities remain within the allowed scope (e.g., don’t accidentally sign the foundation up for a commercial activity). If you plan a change (adding a new beneficiary who isn’t a family member, or engaging in a new investment that could be seen as a business), consult with a tax advisor to see if it could jeopardize the status. Good governance and perhaps legal wording in the foundation’s bylaws/trust deed (like prohibitions on conducting businesses) can help keep it compliant.

In summary, think of obtaining transparent status as getting a special tax privilege – you have to apply for it, then continually certify that you deserve it. The FTA will want to ensure only genuine family wealth vehicles get this benefit. The compliance steps are there to prevent abuse and to make sure the system is fair.

Does My Foundation or Trust Qualify?

To make this more concrete, here are a few real-world scenarios (simplified) and whether they meet the criteria for a fiscally transparent Family Foundation:

Family Investment Foundation: The Al Mansoori family establishes a foundation in ADGM to hold their savings, a portfolio of stocks, and two villas that are rented out to generate income for the family. The foundation’s bylaws state it’s for the benefit of Mr. and Mrs. Al Mansoori and their children (all natural persons). It does not engage in any commercial business – it just collects investment income and distributes it to the family as needed. Outcome: This clearly meets all the conditions: beneficiaries are identifiable family members (individuals), the activity is holding investments and property (passive), no business activity is conducted (renting property that the family owns is considered investment activity, akin to personal real estate investment income[40][41]), and obviously the main purpose is estate planning, not tax avoidance (in fact, if held individually the income wouldn’t be taxed either). There are no charity beneficiaries so the distribution condition doesn’t apply. The foundation can apply to the FTA to be treated as an Unincorporated Partnership. Once approved, it pays no corporate tax itself – the rental and investment income flows through to the parents and children. Since UAE doesn’t tax individuals on such income, the effective tax is 0%. This is exactly the outcome the family intended by using the foundation.

Foundation Running a Family Business: The Khan family transfers their operating business (a chain of retail stores) into a RAK ICC foundation. The foundation owns 100% of “Khan Stores LLC” which runs the actual retail business. The foundation’s beneficiaries are family members. However, the family also has the foundation directly opening new store locations and signing commercial contracts in its own name (not just through the LLC). The business activities generate significant trading income. Outcome: This structure fails the “no business activity” condition – the foundation is itself carrying on a Business Activity (retail trade), which a natural person would need a license for. Even though it’s for the family’s benefit, and even if that business was historically family-run, the tax law draws a line: a foundation that actively carries on a business cannot be treated as a transparent Family Foundation. The foundation would be treated as a normal taxable company and subject to 9% corporate tax on its retail profits.(Even if the foundation wasn’t doing it directly, if its subsidiary Khan Stores LLC is doing business, that LLC cannot be transparent, so its profits would be taxed. The foundation might still qualify on its own passive holding of the LLC shares, but since the LLC is taxable, the income gets taxed at the LLC level before dividends go to the foundation. Either way, the operating profits face corporate tax.) The family in this case doesn’t get a tax-free pass on their business income by using a foundation.

Trust with Only Individual Beneficiaries: A discretionary family trust set up in the Cayman Islands (with no legal personality) has UAE-resident beneficiaries (siblings who inherited assets). The trust holds an investment account and a Dubai apartment that’s rented out. This trust, being unincorporated, is by default transparent in the UAE – it’s essentially like a partnership. If it meets the Family Foundation conditions (which it does: beneficiaries are individuals, it’s merely holding savings and property, no active business, etc.), then the UAE would regard it as a Family Foundation. Outcome: The trust itself doesn’t pay tax in the UAE. The rental income from the Dubai property is UAE-sourced, but since the trust is transparent, that income is treated as the siblings’ income. Under UAE tax rules, an individual’s rental income can be considered “Personal income” and generally not taxed unless they opt to treat it as business. So likely the siblings pay no CT on it (assuming they don’t have to register under any business criteria). The foreign trust can apply (through perhaps its trustee) to be formally acknowledged as a Family Foundation, although technically it’s already transparent without application. If, down the line, this trust owned a UAE holding company, that company could also apply to be transparent because its owner (the trust) qualifies as a Family Foundation.

Foundation with Mixed Beneficiaries (Individuals + Charity): The Patel family foundation in Dubai is set up to benefit the Patel family members, but it also lists the family’s charitable foundation (a registered non-profit) as a 25% beneficiary. The foundation holds a portfolio of investments generating income. It meets all the standard conditions (passive, no business, etc.) except now we must check the distribution condition due to the charity. Suppose the charity is entitled to 25% of any yearly income. To satisfy the distribution condition, the foundation has two options: either distribute the charity’s full share of the income to it before the end of each year, or ensure the charity’s share in the foundation’s accumulated assets/income doesn’t exceed one-third. In this case, 25% is within one-third. Outcome: If the foundation either pays out the 25% to the charity annually, or keeps the charity’s interest below ~33%, the distribution condition is met. Then all conditions are fine and it can be transparent. But if the foundation failed to distribute and the charity’s interest crept above one-third of the foundation’s value, the foundation would lose its transparent status and become taxable. So, families including charities must be careful to follow the rules each year. Assuming they do, the foundation pays no tax; the family’s share of income isn’t taxed (as it’s personal investment income) and the charity’s share is effectively not taxed because charities are often exempt or the income is used for charitable purposes (and the charity would be an Exempt Person if it’s a Qualifying Public Benefit Entity).

Lapse of Conditions Mid-Year: Family Foundation X has been approved as transparent. It owns 100% of a holding company (Y) which in turn owns a property company (Z). All have been transparent so far. In 2025, Foundation X adds a non-family friend as a 10% beneficiary without realizing this might be an issue (the friend is a natural person, so beneficiary condition is still okay). However, in 2025 the foundation also starts providing paid investment advisory services to some outsiders (generating fee income). This likely constitutes a Business Activity (providing services for a fee is commerce). Outcome: By doing so, Foundation X violates the “no business” condition during 2025. It will lose its transparent status from the start of 2025. That means for the entire 2025 year, Foundation X is treated as a normal company any UAE-source income it has (rent, fees, etc.) is taxable. Consequently, its subsidiaries Y and Z also can no longer be transparent (the chain is broken at the top). This scenario illustrates that a foundation can qualify initially but later fall out of compliance and the tax benefits will be lost for that period. The family would need to either cease the disqualifying activity and reapply, or accept that the structure is taxable going forward.

Each family’s situation can vary widely, so these examples are simplified. But they show that as long as the structure remains a pure family wealth holding vehicle, it can likely qualify for very favorable tax treatment. Introduce outside business or stray from the criteria, and the tax man comes back into the picture.

Frequently Asked Questions (FAQ)

Is my foreign trust or foundation taxable in the UAE?

A. It depends on its activities and what assets it holds in the UAE. The UAE does not require a Family Foundation to be formed locally – foreign foundations or trusts can qualify for tax-transparent treatment if they meet the Article 17 conditions [2]. If your foreign trust has no legal personality (common law trust), the UAE already views it as transparent by default [45]. Any UAE-source income (like rental income from UAE property) would flow to you as the beneficiary. If you’re an individual, you typically wouldn’t be taxed on that passive income in the UAE. However, if a foreign foundation (with legal personality) earns UAE income (say it owns a UAE property or business), technically it would be seen as a non-resident juridical person deriving UAE-source income and thus could be taxed on that income. To avoid that, it should apply to be treated as an Unincorporated Partnership (assuming it meets the Family Foundation tests). In short: being foreign doesn’t disqualify you, but you still need to meet the conditions. Ensure you register any foreign foundation/trust with the FTA if it has UAE assets or income, and seek the Article 17 election if applicable. Always check both UAE tax law and your home jurisdiction’s law – the UAE might treat your trust as transparent, but you also want to avoid any double taxation or issues abroad.

My foundation holds a LLC that owns a property. Do both have to apply?

Yes. The foundation itself (if incorporated) would apply to be transparent, and the LLC (Subsidiary) can also separately apply to be treated as an Unincorporated Partnership. The LLC will only be approved if it is wholly owned (directly or through other transparent entities) by a Family Foundation and it independently meets the Article 17 conditions (principally, it should just hold assets and not do business). In your case, if the LLC just holds a property (passive rental income) and is 100% owned by the foundation, it should qualify. The result after approval is that neither the foundation nor the LLC pays tax – the rental income passes straight to you (and any other beneficiaries). Be mindful that each entity in the chain needs to maintain the conditions. If in future the LLC started a side business (say, a property development arm), it would no longer qualify and would become taxable (and could also break the chain for any entities beneath it). But a simple property-holding subsidiary is exactly the kind of entity the rules anticipate being part of a Family Foundation structure.

Do I need to register an “automatically transparent” trust with the FTA?

Yes, you likely do. Even if your trust or unincorporated partnership is by default fiscally transparent, the FTA wants such entities to register for corporate tax (to formally recognize their status). You won’t be filing tax returns like a normal company, but you will probably have to file that annual confirmation we discussed, to affirm each year that you still meet the Family Foundation criteria. Registration is important also to deal with any reporting of income to beneficiaries or claiming of foreign tax credits. It’s essentially a way of saying “Hi FTA, we exist, but we’re transparent.” If you fail to register, the FTA might not know your trust is supposed to be transparent – which could lead to confusion or the FTA treating the trust’s UAE income as taxable to the trustee/company by default. So yes, even transparent entities must register and comply with the relevant administrative requirements.

If our foundation meets all the conditions, is it automatically tax-free?

Not exactly if it’s an incorporated entity, you must apply and be approved to get the tax-free (transparent) treatment. Meeting the conditions is necessary, but you still need the FTA’s green light (via the Article 17 application) to be exempted from corporate tax. Once approved, the foundation becomes “fiscally transparent” – which is effectively tax-free at the entity level. If it’s an unincorporated trust, there’s no application needed to be transparent (it already is), but it’s only deemed a “Family Foundation” if it meets the conditions. In both cases, there’s an element of ensuring compliance: either a one-time application or a self-assessment that you meet criteria. Important: being transparent doesn’t necessarily mean no one pays tax on the income – it means the entity doesn’t. If the beneficiaries were, say, UAE companies or non-individuals, they might owe tax on the income flowing to them. In most family cases, beneficiaries are individuals who aren’t taxed on dividends, interest, capital gains, or rental income (outside of a business) so effectively the income isn’t taxed at all. But transparency doesn’t confer exemption to a beneficiary that is otherwise taxable. For example, if a Family Foundation has a UAE resident corporate beneficiary, that company would include its share of foundation income in its taxable income (since the foundation is see-through). Generally, families design these so that beneficiaries are individuals or exempt entities, so no tax arises on their end either.

Our single-family office company provides services to the family. Can it be a Family Foundation?

No, a single-family office (SFO) or multi-family office (MFO) structured as a company is considered to be conducting business (management services, investment advice, etc.), even if only for the family members. Such entities are taxable like any other company on their profits. They do not qualify as Family Foundations because they fail the “no business activity” and “principal activity” conditions – their main activity is providing services (a business) rather than just passively holding investments. The Family Foundation regime is not intended for service-providing entities; it’s for holding vehicles. So while your family office’s entities under management (like foundations/trusts it administers) might be transparent, the fee-earning management company itself won’t be. In practice, many families have both: a Family Foundation holding assets (tax-transparent) and a service company or office that runs operations (taxable on any fees it earns). The bright side is that the investment income and assets can be in the foundation, tax-free, while only the relatively smaller management fee revenue of the family office company faces tax.

What happens if we break a condition for a short time?

The rule is pretty unforgiving – if you don’t meet all conditions for any part of a tax period, you’re out for the whole period. There isn’t a concept of a “grace period” in the law. If, for example, halfway through the year you accidentally take on a non-qualifying beneficiary or the foundation earns some business-type income, the FTA can consider that the foundation did not meet the conditions for that entire financial year. It would then be taxed as a regular company for that year (and until you requalify). That said, if the breach is rectified and going forward the conditions are met again, you can reapply or regain transparent status for future years. It’s wise to proactively inform the FTA and possibly deregister from transparent treatment if you know you’ll fail the conditions in a year (to avoid penalties for misreporting). Always consult advisors if something unexpected occurs. Careful planning and perhaps built-in restrictions in the foundation’s governing documents can help avoid accidental breaches.

Do beneficiaries pay tax on the income they receive from a Family Foundation?

In most cases, no, the beneficiaries won’t pay UAE tax either, if they are individuals. The UAE Corporate Tax law explicitly keeps personal investment income out of scope for taxation. So if you, as a beneficiary, receive investment or rental income via a transparent foundation, it’s treated similarly as if you earned it directly which for individuals is generally not taxable (unless you’re considered to be doing it as a business). If a beneficiary is a UAE company, that’s different: that company would include its share of the foundation’s income in its taxable profits (so it would pay tax on it). If a beneficiary is a Qualifying Public Benefit Entity (charity), it’s exempt from tax on its income anyway. If a beneficiary is abroad, then UAE CT doesn’t apply to their foreign-sourced income, though the foreign country’s tax rules would need to be considered. So for the typical scenario UAE resident family members as beneficiaries the foundation’s transparency means the income is effectively tax-free for them as well. They do not file corporate tax returns; they would only need to consider if any personal tax obligations arise (currently, UAE has no personal income tax). Always keep an eye on whether any future changes might tax certain personal income or if your scale of activity triggers the need to register (for example, if an individual’s real estate leasing is above a threshold, they might be seen as a business but current guidance suggests that passive rental by individuals is not subject to CT by default).

Does using this structure have any downsides?

It comes with administrative responsibilities and some limitations. On the admin side, you have to apply, register, and annually confirm your status with the FTA. There may also be extra reporting to beneficiaries and record-keeping to show who got what income. Another consideration: a Family Foundation cannot be used to actively run new businesses, as we discussed so it’s not a fit-and-forget solution if your family venture into new commercial activities (you’d need separate companies for those). Also, while not a “downside” per se, remember that the transparency is a UAE tax concept; in other countries, your foundation or trust might still be seen as a separate taxable entity. One must coordinate cross-border tax advice. Finally, laws can evolve although the UAE’s current regime is very friendly (0% on personal income, etc.), if in the future the UAE introduced taxes on individuals’ capital income, the benefit of transparency could be less. In summary, for pure investment holding and legacy planning, the Family Foundation route is highly beneficial, but it requires good governance and staying within its lane. That’s usually a small trade-off for the tax savings and structuring flexibility it offers.