Protecting and managing family wealth requires choosing the right legal structure. In the UAE, high-net-worth individuals, business owners, and family offices often consider Trusts and Foundations for estate planning and asset protection. While both serve to safeguard assets and ensure smooth succession, they differ in legal nature and benefits – especially under UAE law. Below, we break down what trusts and foundations are, compare their key features, and explain why UAE Family Foundations have become a preferred solution (particularly with new corporate tax rules). The aim is to provide a clear, client-friendly overview to help you make informed decisions.

Table of Contents

- What is a Trust?

- What is a Foundation?

- Key Differences Between Trusts and Foundations

- Benefits of Foundations for Family Wealth Management

- Pros and Cons: Trusts vs. Foundations in the UAE Context

- Why Foundations often win out in the UAE:

- Alignment with UAE’s Modern Compliance Efforts

- Conclusion

- DY Lawyers & Legal Consultants: Your Trusted Legal Partner in the UAE

- Disclaimer

What is a Trust?

A trust is a private legal arrangement (created by a trust deed or contract) in which a person (the settlor) transfers assets to a trustee to hold and manage for the benefit of beneficiaries. In simple terms, the trustee becomes the legal owner of the assets, but must use them as per the trust’s terms for the beneficiaries’ benefit. Trusts originated in English common law and have a long history as wealth management tools.

- No Separate Legal Entity: A trust is not a company or legal person; it’s a relationship or agreement. The trust itself cannot own property or sue/be sued – it’s the trustee who holds title to assets on behalf of the trust.

- Flexibility: Trust deeds can be tailored to family needs. For example, a trust can be discretionary (trustee decides when and how much beneficiaries receive) or fixed (specific distributions). This flexibility allows adapting to various goals (education, special needs, etc.).

- Privacy: Trusts are generally private. In the UAE’s common law jurisdictions (like DIFC or ADGM), a trust is not registered publicly; the trust deed remains confidential (no public disclosure of terms or beneficiaries.

- Use in UAE: The UAE’s civil law does not recognize trusts on the mainland, but trusts can be established in certain free zones. Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM) – both of which have common law frameworks – allow the creation of trusts under their own trust laws. These trusts function like those in other common law countries, with DIFC/ADGM courts overseeing them. (There is also a newer federal framework for “civil law trusts,” but its implementation on the UAE mainland is still evolving.)

What is a Foundation?

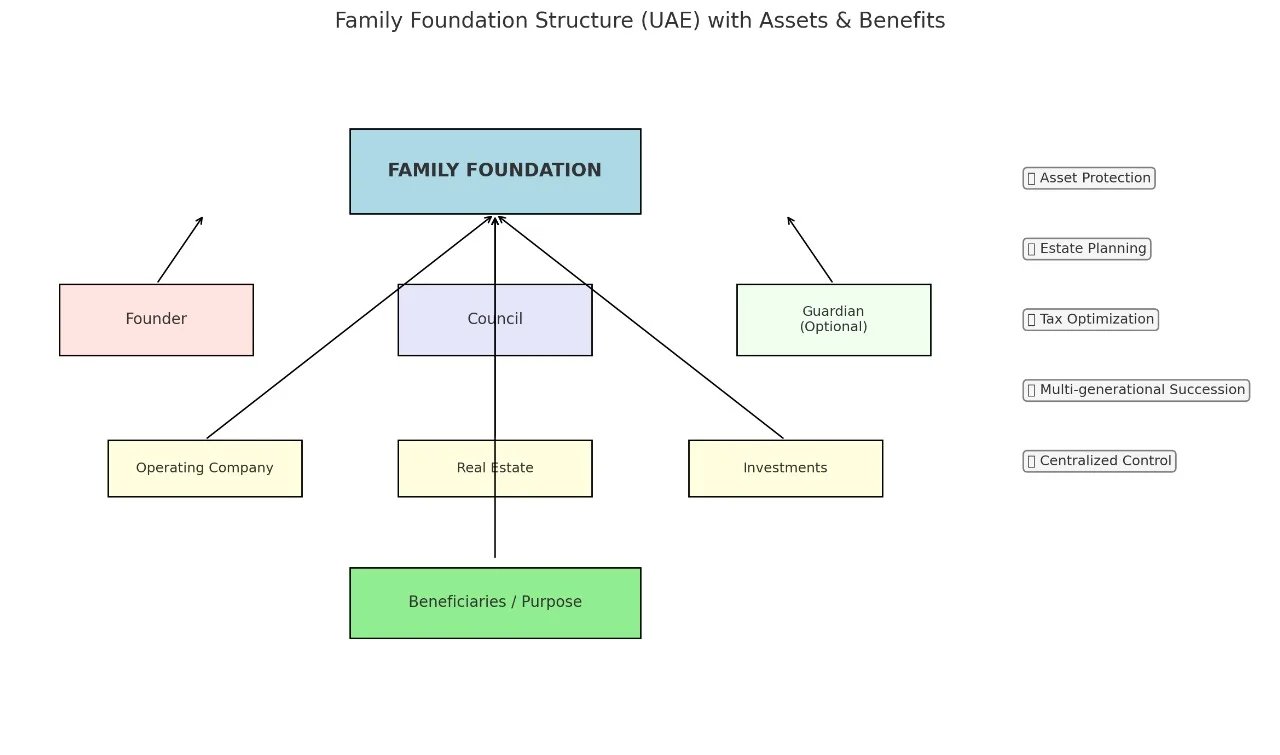

A foundation is an independent legal entity (like a type of private company without shareholders) that is set up to hold and manage assets for the benefit of beneficiaries or a specified purpose. The person who creates it (the founder) endows the foundation with assets, and from that point the foundation itself owns those assets. A council (similar to a board of directors) manages the foundation according to the founder’s charter and by-laws, and per the founder’s objectives. Foundations are sometimes thought of as a civil-law alternative to trusts – they resemble the “Stiftung” in Europe or family foundations elsewhere.

- Separate Legal Personality: Unlike a trust, a foundation is a legal person – it can own assets, enter contracts, and continue in existence in its own named. There are no shareholders or owners; the foundation is “orphaned” – the assets are no longer in an individual’s name or a trustee’s name, but in the foundation’s name.

- Governance: The foundation is governed by its charter and by-laws (legal documents stating its purpose, rules, and governance structure). A foundation council manages day-to-day affairs and must act in line with the charter/by-laws and in the foundation’s best interests (much like trustees have fiduciary duties). The founder can also appoint a guardian or advisor to oversee the council. This formal governance provides structured oversight and continuity.

- Purpose and Beneficiaries: Foundations can be set up to benefit specific family members, classes of persons, or even charitable causes. Unlike a trust, a foundation isn’t required to have beneficiaries – it could exist to carry out a purpose (e.g. hold family assets for future generations or charitable giving. Family Foundations typically name family members as beneficiaries and define how and when they benefit.

- Use in UAE: The UAE introduced foundation regimes in its financial free zones to support wealth management. DIFC (Dubai) and ADGM (Abu Dhabi) both have modern foundation laws (enacted around 2018) that allow UAE or foreign families to establish family foundations with perpetual existence and strong legal protections. Other jurisdictions like Ras Al Khaimah International Corporate Centre (RAKICC) also offer foundation structures. On the UAE mainland, foundations are not yet available under civil law (the concept exists only in those special jurisdictions), making DIFC/ADGM foundations popular for local and expat families in the UAE.

Key Differences Between Trusts and Foundations

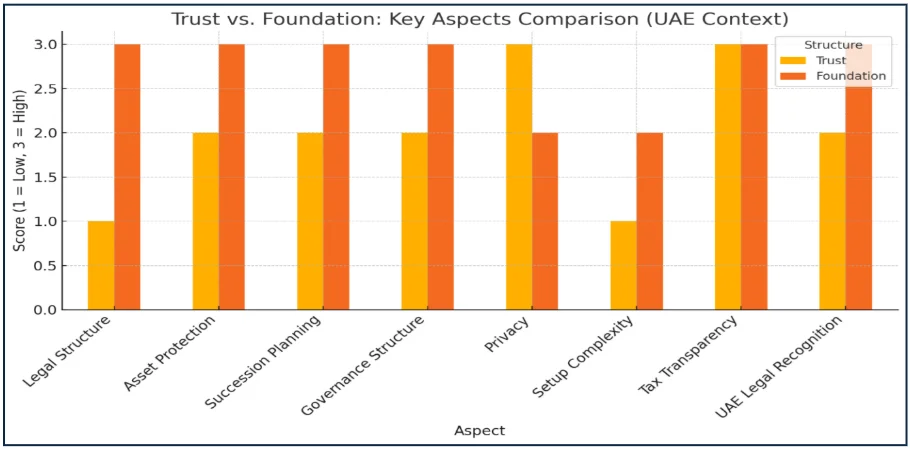

Trusts and foundations ultimately serve a similar purpose – preserving and managing wealth – but they differ in structure and operation. Below is a comparison of key aspects:

| Aspect | Trust (Common Law) | Foundation (UAE Family Foundation) |

| Legal Structure | Not a separate legal entity. A trust is a private legal relationship between settlor, trustee, and beneficiaries. The trustee holds assets in their name for others. | Separate legal entity. A foundation is an incorporated juridical person created by statute, with its own legal personality (like a company without shareholders). The foundation itself owns the assets. |

| Ownership of Assets | Trustee has legal title to trust assets and enters into deals on behalf of beneficiaries. Beneficiaries have beneficial interests, but not direct control. | Foundation holds assets in its own name and can enter contracts itself. No outside person owns the foundation or its assets – they’re held for the foundation’s stated purposes/beneficiaries. |

| Governance & Control | Trustee(s) manage the trust assets as per the trust deed. The settlor can provide a letter of wishes, but typically the trustee has discretion (within the deed’s terms). Control is vested in the trustee – the founder (settlor) usually relinquishes direct control once the trust is settled. | A foundation is managed by a Council (appointed by the founder) that must act per the charter/by-laws. The founder can retain some influence by setting the rules and possibly serving on the council or appointing a guardian. The structure is less flexible day-to-day than a trust, but it provides oversight and can be tailored at the setup stage. |

| Duration | Often subject to duration limits (e.g. some trusts end after a set period or upon an event). In DIFC/ADGM, trusts can be long-lasting, but traditional common law trusts might be limited by rule against perpetuities. | Designed for perpetual or long-term existence. A foundation can continue indefinitely beyond the founder’s lifetime, making it ideal for multi-generational succession. |

| Regulation & Registration | Typically, not registered with a government registry. The trust deed is a private document. In DIFC/ADGM, trusts are formed by trust deed without public filing, though a trustee can obtain a certificate of trust existence if needed. There’s minimal regulatory oversight beyond the general trust law and courts. | Must be registered with the relevant Authority (e.g. DIFC or ADGM registrar) to come into existence. A Charter (a short document) is filed, and a license or certificate of registration is issued. The charter often just names the foundation and perhaps the initial council; detailed terms can remain in by-laws (kept confidential). Ongoing compliance (e.g. annual renewals, updating council changes) is required. |

| Privacy | The terms of a common law trust and the list of beneficiaries are not disclosed to any public body in the UAE. Only the trustee and relevant parties know the details. | Limited disclosure – Basic foundation details (name, founder’s name, registered office, etc.) are maintained by the registrar (not publicly searchable without authorization). Beneficiaries’ identities and by-laws are kept confidential by the registrar. Thus, foundations offer confidentiality, though slightly less than an unregistered trust since an authority oversees their records. |

| Beneficiaries Requirement | Generally must have identifiable beneficiaries (except charitable or purpose trusts which have special rules). Trusts are typically set up to benefit family members or other named persons/groups. | Having beneficiaries is optional. Foundations can be purely for a purpose (e.g. holding family assets or charity) or for beneficiaries. Family foundations usually do name family beneficiaries, but the flexibility allows a founder to define a broad purpose if desired. |

| Use in Business | Can hold shares of businesses or even operate businesses through the trustee. Trusts are often used to hold family company shares. A trust itself isn’t a company, but the trustee can engage in transactions (some jurisdictions allow trusts to be used commercially, but primarily they’re for holding assets). | A foundation cannot actively carry on a commercial business itself (it’s meant to be a holding/asset management entity). However, it can own companies that conduct business. For instance, a family foundation might hold 100% of a family business company, but the business operations stay within that subsidiary company. |

| Assets Protection | Provides asset protection through separation – assets are no longer in the settlor’s personal name. However, since the trust relies on trustees, there is some risk if a trustee faces personal legal issues or fails in duties. The trust’s effectiveness can also be challenged if not properly structured (especially in jurisdictions that don’t fully recognize trusts). | Offers strong protection: assets in a foundation are separate from any individual’s estate, which helps shield them from personal creditors, divorce settlements, or forced heirship claims. UAE foundation laws explicitly aim to protect foundation assets from claims against the founder or beneficiaries. In practice, this means a family’s assets in a foundation are legally ring-fenced – an important advantage in jurisdictions (like the UAE) where Sharia-based forced heirship might otherwise apply. |

| Succession Planning | Trusts are commonly used for succession – assets are held by the trustee and can be distributed to beneficiaries over time, including after the settlor’s death. However, because a trust lacks legal personality, the continuity depends on trustees. A robust trust will appoint successor trustees to carry it on. The settlor’s death does not disrupt a well-structured trust, but the trust may eventually terminate at a set time or once its purpose is fulfilled. | Foundations are excellent for succession planning. Since the foundation is a legal person with perpetual life, the death of the founder does not affect ownership of the assets – the foundation simply continues per the charter. The founder’s wishes (as encoded in the charter/by-laws) dictate how and when beneficiaries (e.g. children, future generations) receive benefits. This avoids local probate procedures entirely – the assets aren’t part of the founder’s estate at death. The structure provides a lasting legacy vehicle with clarity on succession from the outset. |

| UAE Tax Treatment | Transparent by default. Because a trust is not a company, UAE corporate tax generally does not consider the trust itself a taxable person. Any income is attributed to the trustee or beneficiaries. In practice, under the new UAE corporate tax regime, a common-law family trust would likely be treated similarly to a family foundation that has obtained transparent status – i.e., the trust itself wouldn’t be taxed, and only if a beneficiary or trustee derives UAE business income would that be taxed in their hands. (This was straightforward in the past when UAE had no personal or corporate tax on such income but now the situation is different and corporate tax may apply on the income.) | Treated as a company by default, but can opt for transparency. A foundation, having legal personality, is considered a corporate taxpayer unless it meets conditions to be excepted. By UAE Corporate Tax Law, family foundations can apply to be treated as an Unincorporated Partnership (transparent entity). If approved, the foundation itself pays no corporate tax (just like a trust) – see “UAE Corporate Tax Treatment” section below for details. Without that status, a foundation would technically have to register and potentially be subject to 9% corporate tax on income (though purely passive investment income might not trigger tax if not deemed a business). |

In summary: Trusts are contractual arrangements relsiant on trustees, offering flexibility and privacy, whereas foundations are incorporated entities offering structure, legal certainty, and strong asset protection. UAE law has embraced foundations in recent years as a robust tool for family wealth, complementing the trust offerings in its common law free zones.

Benefits of Foundations for Family Wealth Management

While both trusts and foundations can serve estate planning and asset protection goals, UAE Family Foundations offer distinct advantages that appeal to families and business owners:

✅ Legal Protection of Family Estates: A foundation provides a high level of asset protection. Because the foundation owns the assets in its name, those assets are generally shielded from personal claims against the founder or beneficiaries. For example, if a family member faces creditors or a divorce, assets held in the foundation are not legally their personal property, and thus often out of reach. Importantly, UAE foundations can help mitigate forced heirship issues – UAE courts (in DIFC/ADGM) will not apply foreign forced heirship rules to assets held in a foundation. This means the founder’s wishes in the foundation’s charter can override the mandatory inheritance splits that might otherwise apply under Sharia law for Muslim residents, providing peace of mind that the estate will be distributed according to family plans.

✅ Asset Consolidation and Simplified Management: A family foundation serves as a holding vehicle to consolidate various assets – real estate, shareholdings in family businesses, investments, art, etc. – under one umbrella. Instead of assets being fragmented in the names of different family members, everything can be owned by the foundation. This makes management more efficient (one board manages all assets) and allows a holistic investment strategy. It also simplifies reporting and oversight, since the foundation can produce one set of financial statements for all its holdings. Families often use foundations to centralize wealth for family office purposes, streamlining administration.

✅ Succession Planning and Continuity: Foundations are built for succession. Because a foundation doesn’t die or dissolve when the founder passes away, it ensures continuity of ownership and management. The founder can set rules in the by-laws about how the next generations will benefit – for example, specifying that children receive income distributions when they reach a certain age, or that certain key assets (like a family business or a villa) must be held for future generations. This avoids the uncertainties of probate and disputes over inheritance. In essence, the foundation acts like a legacy vehicle, carrying family wealth and values forward. As noted by experts, these structures are ideal for long-term family wealth planning in the UAE’s legal framework.

✅ Control with Structured Governance: A family foundation allows the founder and family to retain control in a structured way. The founder can be on the council or appoint trusted family members and advisors to the council. They can also outline their vision and guidelines in the foundation’s governing documents. This setup can be more reassuring than an independent trustee scenario, since the family has a direct hand in management (often family members feel more comfortable if they or their nominees manage the assets). At the same time, the formal governance (council with fiduciary duties, optional guardian, etc.) ensures decisions are made in the foundation’s (and thus family’s) best interest, with checks and balances. This blend of control and oversight often suits family businesses and estates.

✅ Tax Efficiency and Asset Growth: UAE foundations benefit from the UAE’s tax-friendly environment. The UAE has no personal income tax, no capital gains tax, and no inheritance tax on individuals or on family foundations. With the introduction of a 9% Corporate Tax on businesses, the law specifically carves out relief for family foundations (more on this below), meaning that a properly structured foundation can remain effectively tax-neutral. This allows the family’s assets to grow and be preserved without erosion from local taxes – a significant advantage for wealth accumulation and intergenerational transfer. Additionally, UAE foundations (especially in DIFC/ADGM) can benefit from UAE’s network of double tax treaties if they are classified as UAE residents, potentially reducing withholding taxes on international investments (though if a foundation is tax-transparent, it may not need to use treaties directly, as income is attributed to the beneficiaries). In short, a UAE foundation can act as a tax-efficient holding entity, both domestically and internationally.

✅ Alignment with UAE Regulations: Foundations are recognized by UAE authorities. For example, in Dubai, the Land Department allows DIFC foundations to hold real estate assets in Dubai. Banks in the UAE are familiar with foundations and can open accounts for them. This recognition is an advantage over foreign structures or traditional trusts, which might require additional legal opinions or structures to interface with UAE systems. Using a UAE-based solution also signals compliance with local laws, which can be reassuring for regulatory purposes (say, when moving funds or assets into the UAE).

Together, these benefits make foundations particularly attractive for families in the UAE. In fact, the UAE has positioned itself as a favourable jurisdiction for family wealth structures by offering modern foundation laws that cater to asset protection, succession, and tax optimization needs. Many family businesses and HNWIs are now transitioning to foundation structures (often establishing a “Family Foundation” named after the family) to consolidate their estates, ensure smooth inheritance planning, and navigate the new tax landscape effectively.

UAE Corporate Tax Treatment: Family Foundations as Unincorporated Partnerships

One of the latest developments enhancing the appeal of foundations in the UAE is how they are treated under the new UAE Corporate Tax (CT) regime. The UAE’s Federal Decree-Law No. 47 of 2022 introduced corporate tax on business profits for financial periods starting on or after 1 June 2023. Under this law (often called the Corporate Tax Law), companies (and other “juridical persons”) in the UAE are generally subject to 9% tax on taxable profits above AED 375,000. At first glance, a family foundation – being a company-like entity – would fall under this definition and thus need to pay corporate tax and file returns. However, the law contains special provisions for “Family Foundations.”

What is a Family Foundation under the tax law?

The Corporate Tax Law defines a Family Foundation broadly as “a foundation, trust or similar entity” used to protect and manage an individual or family’s wealth and assets. Essentially, this covers DIFC/ADGM foundations and even trusts, provided their purpose is wealth management/succession (not active business operations). The rationale is that if such an entity is merely holding personal/family investments – the kind of activity that, if done personally, wouldn’t be taxed as business income – then it shouldn’t be taxed as a business just because it’s in an entity form.

Tax Transparency Option: Under Article 17 of the Corporate Tax Law, a Family Foundation can apply to the Federal Tax Authority (FTA) to be treated as an Unincorporated Partnership for tax purpose. In plain terms, this means the entity would be viewed as tax-transparent – not a taxable person on its own. If the application is approved, the foundation itself would not pay corporate tax or even file corporate tax returns; instead, any taxable income would “flow through” to its beneficiaries. Notably, if the beneficiaries are individuals who are just receiving passive investment income, that income would not be taxed either (since the UAE does not tax individuals on dividends, interest, etc., and only taxes business profits. This effectively preserves the tax-free nature of purely private wealth holding structures.

Conditions: To prevent abuse, there are specific conditions for a Family Foundation to qualify for this treatment. Key conditions may include:

- The foundation (or trust) must be established to benefit human individuals (family members, descendants, or even for public/charitable benefit) – not to benefit corporate entities. It should exist for the interest of individual beneficiaries or a charitable cause, similar to how a personal family trust/foundation operates.

- Its main activity is to hold, invest, and manage funds or assets associated with savings and investments of the family. In other words, it’s essentially a passive investment holding vehicle (e.g. holding stocks, real estate, family business shares, cash portfolios).

- It must not engage in commercial business activities that would be considered a taxable business if done directly. The idea is that if the foundation started actively trading or running a business, it should be taxed like any company; but if it’s just managing family wealth, it’s exempt. For example, a foundation can earn investment income, but it shouldn’t be running a full-scale trading company within itself.

- The foundation’s primary purpose should not be avoiding tax. This is a general anti-abuse condition – essentially the structure should have a genuine family succession or asset protection purpose, not merely set up to dodge corporate tax on what is really a business. Given that the UAE’s corporate tax is new and quite low, this condition mainly targets any artificial arrangements.

- The law also allows any further conditions to be set by authorities. (Indeed, additional guidance was later issued by the authorities – discussed shortly.)

If these conditions are met, the foundation can apply to the FTA. Approval is not automatic; an application must be made. If granted, the Family Foundation is treated as tax transparent from the date of approval. Practically, this means:

- The foundation does not file corporate tax returns going forward. It is not considered a taxable entity by the FTA.

- The individual beneficiaries of the foundation will consider any income they receive as if they earned it directly. If those individuals are UAE residents, they would only be subject to corporate tax if that income comes from a business activity. Typically, personal investment income (dividends, rental income, etc.) of individuals is not taxed under the corporate tax law – so in most cases, neither the foundation nor the beneficiary pays tax on passive income streams. Each beneficiary would just need to register and file a return if they personally have to (for instance, if one beneficiary is running a business themselves separate from the foundation’s assets, that business is still taxable, but the foundation’s distributions or held passive income are not.

- If the foundation owns an underlying company that is conducting business, normally that company would be separately taxable. However, a recent update (Ministerial Decision No. 261 of 2024) allows even a company fully owned by a family foundation to elect to be tax-transparent, aligning with the foundation’s status. This is highly beneficial: it means a family foundation can hold assets via another company (for liability or operational reasons) and still maintain an overall tax-neutral position, as long as that company’s role is just holding family investment assets.

The UAE Ministry of Finance and FTA have been active in clarifying these rules:

- Ministerial Decision No. 127 of 2023 initially set out conditions for partnerships and foundations under the tax law.

- Ministerial Decision No. 261 of 2024 (which superseded the earlier rules) refined and expanded the framework for Unincorporated Partnerships and Family Foundations. It confirmed the criteria for family foundations and introduced the allowance for wholly-owned “underlying entities” of a family foundation to also be treated as transparent. It also eased some administrative burdens (e.g. reducing the need for frequent notifications of changes in partnership structures).

In practical terms, to benefit from this:

- The Family Foundation must register for Corporate Tax (even if it plans to be exempt, it starts with a registration so the FTA is aware of it).

- It then submits an application via the FTA’s EmaraTax platform to be treated as an Unincorporated Partnership (tax transparent). This application can be made by the foundation itself or through its tax agent/legal representative.

- The FTA reviews if the foundation meets the conditions. Once approved, the foundation’s status changes – it will no longer have to file or pay corporate tax, as long as it continues to meet the conditions each year.

- The foundation may need to file an annual declaration confirming it still meets the conditions (the detailed procedure for this is being set by the FTA).

- The individual beneficiaries should then evaluate their own registration requirement. If they are UAE businesses or individuals with taxable business income, they might declare their share of any relevant income. In many family cases, the beneficiaries are individuals whose foundation-derived income is passive (not taxable), so usually no further action is needed on their part aside from perhaps a one-time registration or confirmation.

Implications: This tax treatment is a significant advantage. It effectively allows a Family Foundation to function in a tax-neutral manner, similar to how a trust or a simple holding company with no business would in the pre-corporate-tax era. Families can organize their wealth through a foundation without incurring a 9% corporate tax drag on investment yields or having to restructure assets out of the UAE. Additionally, by removing the requirement for the foundation to file returns, it simplifies compliance – less administrative work and worry for family offices. As noted by the FTA, once approved, the foundation “will no longer be required to file Corporate Tax Returns”, aligning with the idea that the compliance burden shifts away from a privately held family vehicle.

This move by the UAE also demonstrates the government’s understanding and support of private wealth structures. The FTA itself stated that enabling Family Foundations to obtain this status “aligns with [its] ongoing efforts to enhance its services in accordance with international best practices, offering comprehensive support…and facilitating smooth and accurate compliance” with the new tax law. In other words, the UAE is modernizing its tax system in a way that continues to encourage family wealth investment and management in the country, rather than penalizing it. High-net-worth families can take comfort that the UAE’s corporate tax regime explicitly accommodates estate-planning entities.

Pros and Cons: Trusts vs. Foundations in the UAE Context

Both trusts and foundations have roles in wealth planning, and the “better” choice can depend on a family’s specific needs. Here we summarize the pros and cons of each in the UAE, with a focus on why many are gravitating toward foundations:

Trusts – Pros

- Flexibility: Trusts are often very flexible. The trust deed can grant broad or narrow powers to trustees, and can be more easily amended (in some cases) or interpreted flexibly to meet the family’s evolving needs. Trustees can often react to circumstances (within their discretion) without needing formal amendments. This flexibility can be useful for dynamic situations (e.g. adjusting distributions based on beneficiaries’ behavior or needs).

- Privacy: Trusts offer a high degree of confidentiality. There’s no registration and no public record. The arrangements and terms remain a private matter between the parties. For families that value discretion above all, a trust can keep affairs out of any registry. Even the existence of the trust may be unknown to outsiders.

- Simplicity and Cost: Setting up a trust (in DIFC/ADGM or via an offshore jurisdiction) can be simpler and quicker than establishing a foundation. It typically just requires a trust deed and the appointment of a trustee. There are minimal upfront costs – in DIFC/ADGM there’s usually no government incorporation fee for a trust, unlike a foundation which has registration fees and possibly agent fees. This makes trusts cost-effective for certain cases or shorter-term arrangements.

- International Recognition: Trusts are well-recognized globally (in common law countries). Many clients and advisors are familiar with trust concepts, and a network of professional trustees exist worldwide. If a family already has a trust in, say, Jersey or the Cayman Islands, they might mirror that structure in the DIFC for local assets. There’s a comfort factor for those from common law jurisdictions in using a trust.

Trusts – Cons

- No Legal Personality: A trust’s lack of legal identity can present practical challenges. For example, if a trust wants to hold UAE real estate, the title might have to be in the trustee’s name (since the Land Department may not register a trust directly). This can complicate matters if trustees change. Similarly, banks might open an account under the trustee’s name for the trust, which can create dependency on that specific trustee’s involvement. In contrast, a foundation has its own name and identity for such dealings.

- Reliance on Trustees: The success of a trust structure hinges on the trustee. The trustee must be reliable and act in the beneficiaries’ best interest. If an individual trustee faces personal legal issues or passes away, or if a professional trust company merges or changes strategy, the trust could be impacted. Mismanagement or even fraud by a trustee is a risk (though legal remedies exist). Basically, the family places a lot of faith in one or more trustees, which may be uncomfortable for some. Good governance in a trust (like having multiple trustees or a protector) can mitigate this, but it’s a point to consider.

- Less Structured Governance: Apart from what the trust deed stipulates, there isn’t a built-in governance body or reporting requirement in a private trust. This informality can sometimes lead to less oversight. In a family context, a domineering trustee could, in worst cases, ignore the non-binding wishes of the family. Without a council or regulators, any issues might only come to light if beneficiaries take legal action. Essentially, the very flexibility and privacy of trusts mean there’s less external accountability.

- Recognition in Civil Law Jurisdictions: While DIFC and ADGM trusts are valid within those jurisdictions, the trust concept may not be readily enforceable in UAE federal courts (outside the free zones). If a dispute arose and landed in a local (non-DIFC/ADGM) court, there might be complications due to the court not recognizing the split ownership nature of a trust. Foundations, being corporate entities, are more easily understood and recognized across jurisdictions (they have analogues in civil law systems worldwide). This is why, for holding local UAE assets, many prefer a foundation – it’s less likely to face legal recognition issues.

- Duration Limitations: Depending on the jurisdiction’s rules, some trusts cannot last indefinitely (though DIFC and ADGM have modern rules that can allow long or even unlimited duration trusts, similar to foundations). If a trust has a 100-year limit, for instance, that might necessitate future restructuring for truly multi-generational plans.

Foundations – Pros

- Strong Legal Standing: A foundation’s independent legal personality gives it permanence and clear standing. It can own property, sue or be sued, and otherwise operate like a company. This makes interactions with banks, registries, and counterparties straightforward – the foundation is simply treated as a corporate entity. It also means the foundation is jurisdictionally anchored (e.g. governed by DIFC law), providing clarity on which rules apply.

- Asset Protection & Stability: Foundations are seen as very secure vehicles. Because of the structured governance and legal separation of assets, there’s less risk of assets being misused or claimed by outsiders. The foundation’s council must follow the charter/by-laws, providing stability in how assets are managed over time. This stability is reassuring for long-term preservation (assets won’t be suddenly redirected contrary to the founder’s mission). Moreover, as noted, foundations protect against forced heirship and can ring-fence assets from personal liabilities effectively.

- Perpetual Succession: A foundation doesn’t end with the founder’s death or at a fixed date – it can truly be multi-generational. This perpetual nature is a major pro for wealthy families wanting to create a lasting legacy (e.g. “Family Foundation” that benefits not just children but grandchildren and beyond). It avoids the need for future restructuring or transfers that a time-limited trust might eventually require.

- Founder’s Influence: In a foundation, the founder can retain influence in a formalized way (for instance, as a council member or through reserved powers in the by-laws). Many families appreciate that the patriarch/matriarch can still guide the management of the assets during their lifetime (and even appoint trusted advisors for beyond). This is harder in a trust, where legally the settlor should not retain control (or else the trust could be viewed as a sham). Thus, foundations can strike a balance between control and independence.

- Tax Benefits in UAE: As discussed, UAE Family Foundations can be made tax-transparent with FTA approval, meaning the foundation will not incur corporate tax. Even without that status, if the foundation’s activities are purely holding investments, it may not have taxable income under UAE law. And UAE imposes no other taxes on foundations (no annual net worth taxes, etc.). In practice, many foundations will qualify for the transparency election, effectively making the foundation tax-exempt, while still allowing it to benefit from UAE’s treaty network if needed. Trusts, by comparison, are automatically transparent but don’t have a separate legal status to even seek treaty benefits – it’s just the trustees/beneficiaries who might claim treaties individually.

- Modern UAE Regulatory Support: The UAE free zones have developed user-friendly processes for foundations – e.g. quick digital registration, relatively low fees, and no requirement for local sponsors or heavy bureaucratic approvals. The legal framework in DIFC and ADGM is based on global best practices from places like Jersey, Guernsey, Liechtenstein, etc. For example, these foundation laws explicitly protect against seizure of foundation assets for foreign claims and allow migration of foundations in and out of the jurisdiction. Such features make UAE foundations world-class. Additionally, the regulators (DIFC, ADGM, RAKICC) often provide guidance and support, and with the FTA’s new rulings, it’s clear the government endorses the use of foundations for family wealth management.

Foundations – Cons

- Formalities and Cost: Establishing and running a foundation involves more formal steps and ongoing duties than a simple trust. You must register the foundation with the relevant authority (involves paperwork and fees). There are set-up fees and annual fees (albeit not very high – e.g. a few hundred to a couple thousand dollars depending on jurisdiction). ADGM foundations require appointing a licensed Registered Agent (corporate service provider), which comes with professional fees. The foundation will typically need to maintain a registered office address in the jurisdiction, keep accounting records, and possibly prepare annual accounts (DIFC/ADGM do not force small private foundations to publicly file financials, but records must be kept). These administrative obligations mean higher ongoing costs compared to an unregistered trust. For large estates, the cost is marginal, but for smaller assets a trust might be more cost-effective.

- Reduced Flexibility: Once a foundation’s charter and by-laws are in place, changing them might require approvals (possibly even regulator approval if it’s a fundamental change) and following certain procedures. The management by a council according to by-laws can be seen as less flexible than a single trustee making decisions on the fly. For example, if a beneficiary’s circumstances change and the family wants to alter distribution plans, a trust with a discretionary trustee could adapt quickly, whereas a foundation might require the council to formally amend the by-laws or the founder (if still alive and with reserved powers) to change the rules – a more involved process. In short, foundations trade some flexibility for structure and stability.

- Initial Setup Complexity: The concept of a foundation might be new to some clients, and setting one up requires careful drafting of charter and by-laws (often with legal counsel). Decisions are needed on who will be on the council, who might be the guardian, what powers the founder retains, etc. This upfront design is very important to get right. With a trust, while trust deeds also must be drafted carefully, clients sometimes find the trust concept more straightforward (“I give it to X to hold for Y”). The foundation’s mechanism (no ownership, council governance) can feel a bit more complex to understand initially. However, with professional guidance, this can be managed.

- Public Perception and Banking: While UAE banks and institutions do recognize foundations, they are still a relatively new structure (DIFC and ADGM foundations have been around only since 2018). Occasionally extra explanations or documentation might be needed to educate counterparties about how the foundation works. Some foreign institutions might mistake a UAE foundation for a charity due to the term “foundation” (since in some countries foundation usually implies a nonprofit) – thus one may need to clarify it’s a private family foundation. By contrast, trusts (especially if using a known trustee company) are widely understood in international finance. This is a minor con that is diminishing over time as foundations become more common.

- No Instant Separation of Roles: In a trust, you automatically have a trustee (who is a separate person from settlor and beneficiary). In a foundation, if not carefully planned, the founder might inadvertently treat the foundation like their alter ego (especially if the founder sits on the council and there’s no guardian). Best practice is to include at least one independent council member or have checks (as highlighted by advisors for good governance). If a foundation is too closely controlled by the founder without observance of formalities, there could be a legal argument (in extreme cases) that the foundation is just a nominee. Thus, families need to observe the governance process properly – which, while not a big ask, is another step of discipline required.

Why Foundations often win out in the UAE:

In the context of the UAE, many advisors lean towards foundations for most family wealth scenarios. The pros of a foundation often align better with the UAE’s legal environment and the needs of local HNW families. Key reasons include:

- The legal recognition of foundations in UAE jurisdictions means they integrate smoothly with owning UAE assets (property, companies, etc.) and are backed by UAE law. Trusts, if not within DIFC/ADGM, could face uncertainty.

- The Corporate Tax transparency option for foundations (and not needed for trusts) actually puts both structures on equal footing tax-wise – but with the foundation you have to actively apply to FTA for it. Many see that as a worthwhile step given the other benefits of a foundation. The government’s willingness to exempt family foundations from tax underscores that foundations are viewed as legitimate family tools, not tax-avoidance loopholes.

- A foundation’s ability to perpetuate family legacy and protect against forced heirship is extremely valuable in a region where succession laws can be complex. It allows non-Muslim expatriate families, for example, to avoid the default Sharia rules by holding assets in a foundation and dictating their own succession plan.

- Founders who want to maintain control prefer foundations because they can be in the driver’s seat (to an extent) without undermining the structure. In a trust, if the settlor retains too much control, it can invalidate the trust; in a foundation, the founder’s involvement is built into the structure in a legitimate way.

- The FTA’s modernization efforts and the UAE’s overall push to be a global wealth management hub have put frameworks in place (like digital registration, clear laws) that make using a foundation relatively straightforward. This reduces the “hassle factor” that one might otherwise associate with an entity structure. As the FTA has highlighted, making family foundations easy to manage is part of improving tax compliance procedures and aligning with best practices.

That said, trusts are not obsolete – they may still be useful for offshore assets or as a complement to foundations. Some families use trusts in foreign jurisdictions alongside a UAE foundation, depending on the asset locations and legal considerations. However, within the UAE, if one had to pick a single comprehensive vehicle for a family’s estate, a UAE foundation often comes out as the more advantageous choice given its robust legal protection, ability to consolidate assets, succession merits, and favorable treatment under new UAE laws.

Alignment with UAE’s Modern Compliance Efforts

The introduction of Family Foundations and their treatment under corporate tax is part of the UAE’s broader effort to modernize and internationalize its legal and compliance framework. The Federal Tax Authority (FTA) and government bodies are ensuring that as the UAE joins the global tax community, it still remains attractive and convenient for private wealth management.

A few points highlighting this alignment:

- International Best Practices: UAE’s trust and foundation laws in DIFC/ADGM were modeled on successful examples from other jurisdictions, and the corporate tax rules (like allowing tax transparency for family structures) mirror practices in Western countries where family trusts or partnerships are tax-transparent. This shows the UAE is adopting globally accepted solutions so that HNW families can operate in the UAE without disadvantage.

- Digital and Efficient Compliance: The FTA launching a dedicated online application for foundations to get tax-transparent status (via EmaraTax platform) demonstrates the push for digitalization and ease of compliance. Families (or their advisors) can handle these formalities online, which is part of the UAE’s vision for smart government services.

- Reduced Burden: By eliminating the need for approved family foundations to file tax returns, the FTA is reducing unnecessary compliance burden on purely private investment vehicles. This not only helps the taxpayers (families) but also streamlines the FTA’s own administration, so they can focus on genuinely taxable entities. The Ministerial Decision 261 of 2024 also removed some onerous requirements (like constant notifications of partnership changes) and instead trusts the annual declaration system – again simplifying life for those who opt in.

- Encouraging Transparency and Registration: The fact that family foundations need to register and apply for the status encourages such structures to be visible to regulators to some degree (even if not publicly). This is in line with global moves towards transparency without sacrificing privacy. It’s a balanced approach: families register their foundation with FTA, declare it’s a family holding entity, and in return they get compliance relief. Everyone wins – the FTA knows these entities are genuine family vehicles (not shell companies hiding commercial income), and the families get peace of mind on the tax front.

- Positioning the UAE as a Wealth Hub: All these measures – modern laws, treaty networks, the absence of personal taxes, and now a considerate corporate tax regime – are solidifying the UAE (and Dubai in particular) as a hub for family offices and wealth structuring. The government’s actions show a clear intent to welcome and accommodate global wealth in a compliant manner. Clients can thus feel confident that using a UAE foundation is not only beneficial for them, but also aligned with the direction of UAE policy (i.e. they are not operating in a grey area; they’re part of an encouraged framework).

Conclusion

In summary, Trusts and Foundations each have their place in estate planning, but under UAE law, Foundations – especially Family Foundations – offer a comprehensive and locally optimized solution for wealthy families and business owners. Trusts provide flexibility and privacy, which some may prefer for certain situations or assets. However, UAE Foundations combine many of the trust’s benefits with additional strengths: legal entity status, strong asset protection, tailored governance, perpetual succession, and now explicit tax advantages under the UAE’s corporate tax regime.

For high-net-worth individuals and family offices in Dubai and the wider UAE, a Family Foundation can act as a one-stop vehicle to protect the family estate, consolidate assets, plan for succession, and optimize taxes, all within a framework recognized and supported by UAE authorities. This aligns with the UAE’s efforts to modernize and facilitate wealth management – clients can achieve their legacy and financial goals while remaining fully compliant with the latest laws.

When deciding between a trust and a foundation, consider the priorities: if you value control, long-term continuity, and local robustness, a foundation is likely the superior choice. Trusts might still be useful for certain flexible arrangements or foreign holdings, but the Family Foundation has emerged as the flagship solution in the UAE context, providing families the tools to secure their wealth for generations. As always, it’s advisable to consult with legal and tax professionals to tailor the structure to your specific needs – but rest assured, the UAE offers a cutting-edge toolkit for safeguarding family wealth in today’s world.

DY Lawyers & Legal Consultants: Your Trusted Legal Partner in the UAE

DY Lawyers & Legal Consultants is a premier law firm based in Dubai, recognized as a Registered Agent with the Ras Al Khaimah International Corporate Centre (RAK ICC). Our team comprises highly qualified lawyers and consultants with rights of audience before ADGM courts and other tribunals.

Comprehensive Legal Services Across UAE Jurisdictions

We offer a wide range of legal services tailored to meet the diverse needs of our clients:

- Family Foundations: Establishment and structuring to protect family wealth and ensure succession planning.

- Trusts: Creation and management for asset protection and estate planning.

- Corporate Structuring: Tailored solutions for businesses, including holding companies and special purpose vehicles.

- Asset Protection: Strategies to safeguard personal and corporate assets.

- Legal Services: Providing sound legal solutions to your corporate and commercial problems.

- Drafting and Reviewing: Tailored legal drafting for sorts of legal documents including but not limited to contracts, agreements, MOA&AOA, Board Resolutions protecting the interest of our clients.

Why Choose DY Lawyers & Legal Consultants?

- Expertise: Our lawyers possess in-depth knowledge of UAE laws and international best practices.

- Client-Centric Approach: We prioritize our clients’ needs, offering personalized legal solutions.

- Integrity: We uphold the highest standards of professionalism and confidentiality.

Disclaimer

The content of this Article is provided for informational purposes only and does not constitute legal, financial, or other professional advice. Neither the author nor DY Lawyers and Legal Consultants makes any representation or warranty, express or implied, as to the accuracy, completeness, or adequacy of the information contained herein, and expressly disclaims any and all liability for errors or omissions therein or for any reliance placed upon such information.

No reader should act or refrain from acting on the basis of any matter contained in this Article without seeking appropriate legal or other professional advice on the particular facts and circumstances at issue. Reliance on any information contained in this Article is solely at the reader’s own risk, and DY Lawyers and Legal Consultants disclaims all liability and responsibility for any loss or damage that may arise from or relate to use of or reliance on such information.